Don't you have an Account with Us ? than sign up now using any of the way...

A man with commitment – Mehrab Irani

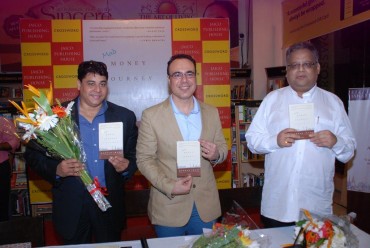

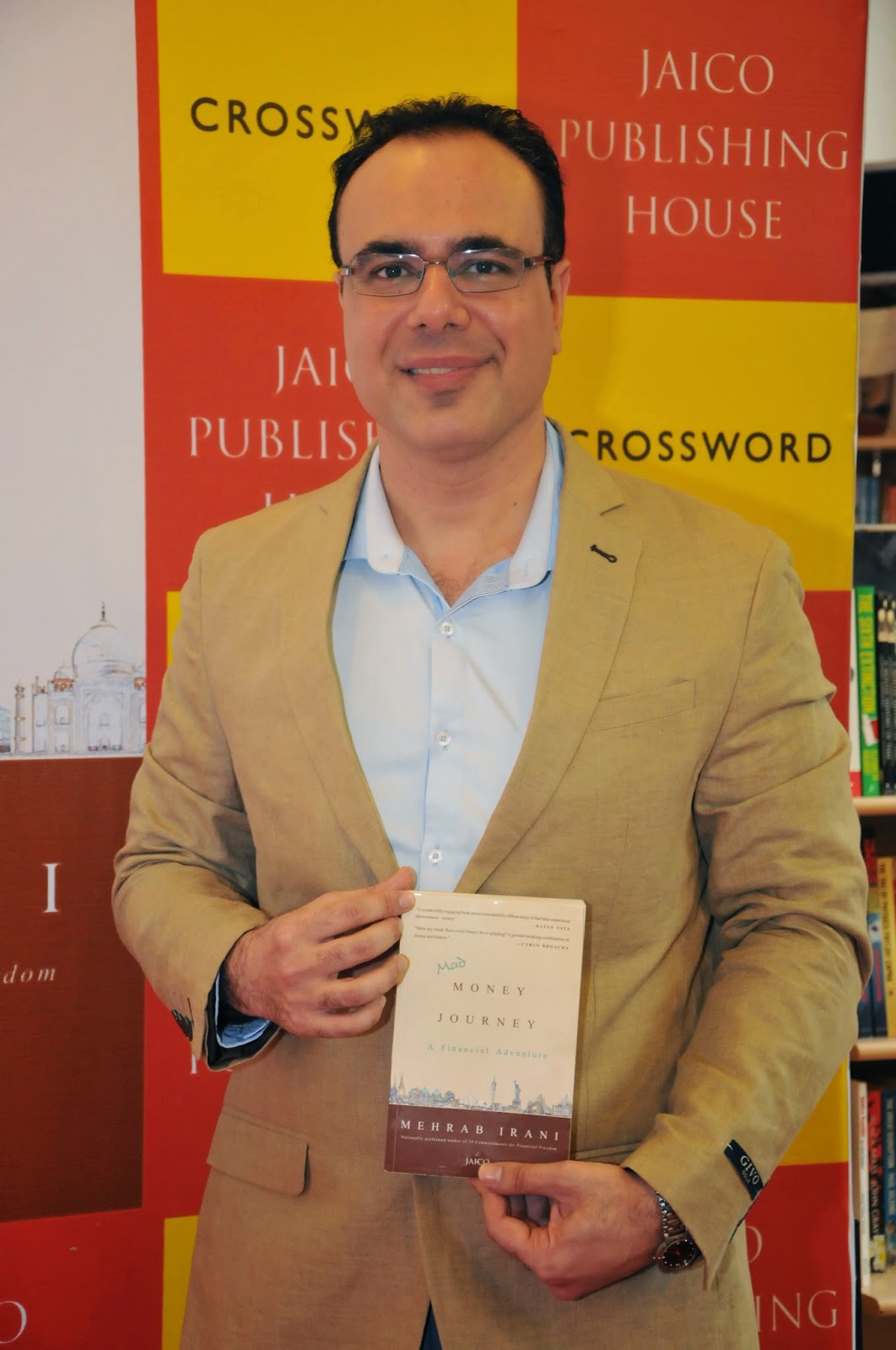

Author Mehrab Irani has delved into a new genre of finance fiction with his new thriller book “Mad Money Journey”. Acclaimed by corporate luminary Ratan Tata himself, the book was launched amidst much fanfare in the presence of veterans Rakesh Jhunjhunwala and funny man Cyrus Broacha.

Mehrab Irani is the General Manager of TATA Investment Corporation and has a large amount of experience in both equity and fixed income markets. He is a regular figure on channels like NDTV, CNBC, ET Now, Bloomberg, Radio Stations etc. besides writing columns for many business publications in his 15 year long and prosperous career.

Today, managing money and finances is a thought that scares people from every walk of life from a college student to a working professional, male or female, educated or uneducated, old or young, author Mehrab Irani presents finance in an entertaining way to his readers in his book ‘Mad Money Journey’. He is also aiming at converting it into a movie. It’s simply like a NGO effort from his side. Lets see how he comes out like from this small interview-

-

WPMI

Not sharing the knowledge you posses is being selfish. My job helps me meet new people and interact with them. I have been working in the finance field for the past fifteen years. What I have observed is that, even today there is lot of misconception about money, finance and investments. Today, most of us have become slaves of money– wage slave of the employer, tax slave of the government and loan slave of the bank. It was disturbing to see human beings turned to financial slaves. Money is the most important factor which comes between man and his dreams. Some work definitely needs to be done on this. God has given each one of us a special gift- unique talent which is to be recognized for the common benefit. Most of the people have abolished their dreams in the search of a safe secured life. Take the example of a teen boy who is very good at cricket and wants to become a cricketer but is socially pressurized to become a doctor or an engineer for a “safe secure life”. In the name of this so called illusion of “financial security” the boy is pushed into leaving aside his dream and live a whole life of slavery. This disturbing thought made me write about it to become an author.

-

WPMI

We are all born genius but, most of us die in mediocrity. As children, we are not afraid to dream and yearn for everything. But, as time passes, a mysterious force begins to convince us that it is not possible. In this physical world, financial slavery is one of the prime reasons which prevents humans from achieving the purpose of their soul. The teen boy about whom we spoke about previously is forced to neglect his dream and prefer a life of slavery. This is what hits me a lot. I wrote the book to free humanity from financial slavery, so that they can achieve their true higher purpose and fulfill the very reason of their existence on this planet.

-

WPMI

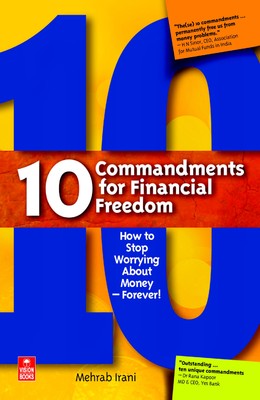

“10 Commandments for Financial Freedom” is a simple straight forward book which gives the 10 principles of earning, protecting, budgeting, saving, spending, investing, leveraging, insuring, common financial mistakes and rules of money. When you ask a housewife if what she is doing with money she says, “I don’t know my husband or father is looking at it”; when we ask a young educated professional who has just started working if what are his/her future plans s/he says, “I don’t know, just now I am busy concentrating on my career”, when we ask a middle aged experienced professional if what are his/her retirement plans s/he replies, “I don’t know I have invested in that mutual fund”. The worry is we actually don’t know what money is! And if we don’t know how to deal with money– many times our life journey might become madly. So, the idea of “Mad Money Journey” came up. It combines the principles of money, finance and investments on one side and of life and wisdom on the other side. The readers taking the Mad Money Journey would permanently change their path by putting themselves in the right way where, they will be introduced to their inner self. Hence, to connect with readers in an innovative way, I moved from fiction to non-fiction.

-

WPMI

When a woman can handle her education, family, her job, the boardrooms and the government etc. Than, how on earth can she not handle money or investment? In the old days there used to be barter system. Then man created money as a medium of exchange and store of value. However, over the period of time– the creator became slave of his own creation. Women by not managing their own money are not only becoming slaves to money but also slave to men which then encourages men to exploit her – physically, mentally and emotionally. It’s time that women wake up to this reality and take charge of the situation. Managing money is as much a scientific process as is an art and a psychological thing. When women will start on her financial freedom journey she might receive lot of negative advice from lot of people. The more she worries about being applauded by others and making money, the less she will focus on doing the great work that will generate applause and make her money. To double her net worth, she has to first double her self-worth because she will never exceed the height of her self-image. The most dangerous place is her safety zone. I want each woman to come out of her safety zone, recognize and connect with her dreams, get the courage to live her dreams, become financially independent.

-

WPMI

Managing money has nothing to do with gender or sex. Money is not masculine nor feminine. Money is money and it is neutral towards male or female. It’s the birthright of each individual to achieve financial freedom. Even today, in a liberalized Indian society an educated and working woman is primarily expected to take care of the family and house. If she is earns money, she is seldom part of the financial decision making. A woman, whether working or not, is always made to depend on male for her financial needs. Is it not her right to live a financially free life wherein she can also explore her dreams and fulfill her higher self-actualization goals? Yes, women, even the educated and earning ones, do shy away from taking financial decisions since she is taught this from childhood to not engage herself in money matters.

-

WPMI

Yes Certainly. My book “Mad Money Journey” will inspire and motivate each and every woman irrespective of her current status, position, education or any other factor. Women have to be inspired to earn, invest and grow their wealth so that they can attain financial freedom. In our patriarchal society, where already lot of crimes are being committed against women, lack of financial freedom and dependence on a male member for her finances makes a woman very vulnerable. The primary reason is that the ego of an average Indian male would be affected if the woman of the house would start taking financial decisions. Today, we see young educated women earning very good income but then not able to protect their money from financial predators, they pay everybody but forget to pay themselves as a surplus budget. They don’t know when to cut spending and when to spend to get rich. It’s a simple mechanical principle- the litmus test that even an uneducated person would understand the plan. Just utilize money judiciously.

-

WPMI

Women are susceptible to many financial and simple money mistakes. Don’t let money buy your love because ultimately, it will be you who will lose. Never commit adultery because of money. If your husband is poor but honest don’t just break his trust by entering into relationship with a rich guy. A man who lures a woman by showing his money is not worth your trust or love. Control your indulgent mind when you see the next “sale or discount offer” on your favorite clothes, garments, jewelry etc. Remember that a 40% sale still means than you have to pay the remaining 60% and if you keep buying the things which you don’t require than very soon you will have to sell the things which you require. Never force your husband into a job or profession because “you” think that he will earn more money in that and give you a better life. Let him explore his ownself and settle in the work which he loves– that will assure your family’s financial freedom as well as love. Get involved in the long term financial decision making. Be a part of it and give your valuable contribution – it will improve your family’s finances as well as boost your personal morale.

-

WPMI

Women are no way lesser than men in any manner. Infact, in most cases women are superior; being more patient and tolerant than men. The worst part is that, in most cases woman doubts her own ability for the failure. Most of the times when a heinous crime like rape is committed on a woman, she keeps quiet or is forced by family to keep her mouth shut to protect their false respect. Coward are those men who damage her body by raping her rather than winning her heart and soul. But, the whole point here is that women have to come out of their shell. They should face their problems, win over the circumstances and come out victoriously. Women should learn to respect themselves. Every woman is unique, just have courage to live your dreams. All my best wishes to each and every woman on this planet.

Comments